Caution: Tax risks ahead!

Many businesses have risk management processes and procedures in place to cover the risks related to their activities. However, very few of them have implemented protocols for managing tax risks and opportunities.

This comes as a surprise, as tax risks are very real and could seriously hurt any organization if not properly mitigated. In recent years, the federal and provincial governments have focused on the recovery of what they define as the “fair tax portion” to be paid by every taxpayer. More specifically, Quebec and the federal government have adopted programs requiring the disclosure of aggressive tax planning. Furthermore, in order to recover uncollected or unpaid taxes, governments are increasing human resources dedicated to businesses and taxpayers tax audits. The Canada Revenue Agency plans to allocate 800 million dollars over the next five years to tackle tax compliance problems. And last but not least, tax authorities have used technology to better focus their audit activities on risk areas.

Why tax risk management?

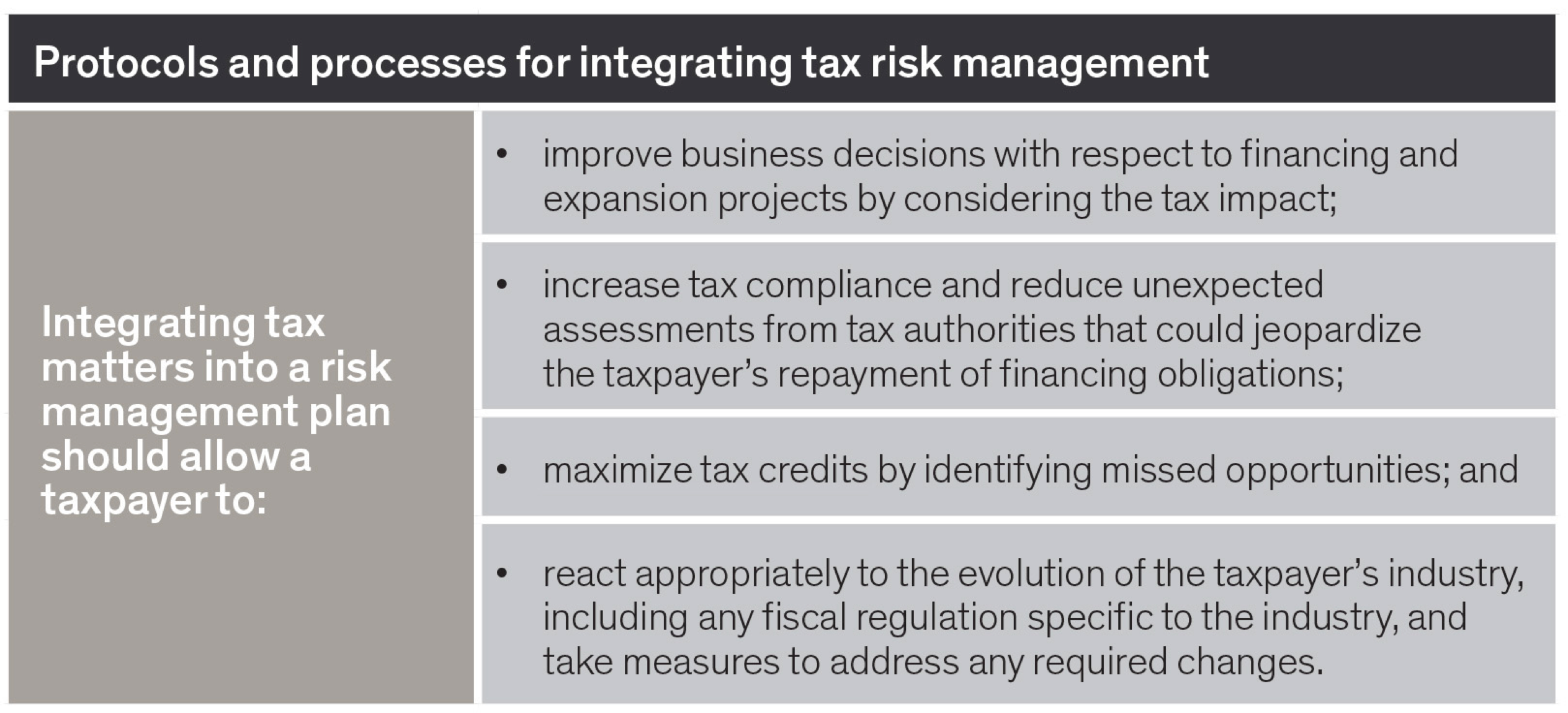

The additional human and technological resources are likely to increase the number of tax audits, which can target completely honest businesses. Tax risk protocols and processes can ease the management of a tax audit and estimate its results. A tax management framework can also be used by the taxpayer when negotiating financing with a financial institution. Lower tax risks may have a positive impact on the financing terms.

Benefits of tax risk management

Tax risk management has multiple benefits for your organization.

Know your risks

In order to integrate tax into risk management protocols and processes, a taxpayer should begin by establishing the tax risks associated with his industry and the specific characteristics of his business and activities. For example, the construction industry has specific risks, such as undeclared work or fraudulent subcontractors. This step allows the taxpayer to determine whether these risks are material to the business.

Once these risks are defined and quantified, the taxpayer can determine and analyze the best way to comply with his tax obligations and demonstrate compliance in case of a tax audit. This evaluation could also reveal opportunities, for example to claim increased tax credits, to obtain grants or to undergo reorganization for added tax efficiency.

Easing the tax audit

Tax audits are always a burden: they monopolize resources and create a climate of uncertainty within your company. Proper tax risk management can greatly ease a governmental audit. Once protocols and processes are in place, including the maintenance of proper documentation justifying the tax treatment of transactions, a taxpayer should be able to work effectively with tax authorities if a tax audit is conducted. And, as with many other things in life, communication is key

to any tax audit.

With these processes and protocols in place, a taxpayer can feel more confident in dealing with a tax auditor requesting documentation and other information. Possessing knowledge of his own tax affairs and processes should enable a taxpayer to provide information to the auditor in the most efficient manner which can greatly shorten the length of any tax audit.

Among other best practices in the management of a tax audit, the taxpayer and the auditor should establish a schedule upfront for the work that needs to be performed, the steps needed to accomplish it, and the documentation or information that must be provided. It is also important to ensure at the outset and throughout the audit process that documents and information that are provided to the tax auditor are complete and easy to understand.

Getting started

The processes and protocols necessary for tax risk management have several advantages, such as determining whether an organization is compliant and managing tax audits more efficiently. Get started by consulting an expert today!

About Richter: Founded in Montreal in 1926, Richter is a licensed public accounting firm that provides assurance, tax and wealth management services, as well as financial advisory services in the areas of organizational restructuring and insolvency, business valuation, corporate finance, litigation support, and forensic accounting. Our commitment to excellence, our in-depth understanding of financial issues and our practical problem-solving methods have positioned us as one of the most important independent accounting, organizational advisory and consulting firms in the country. Richter has offices in both Toronto and Montreal. Follow us on LinkedIn, Facebook and Twitter.