Real Estate Advisory

When assets are enduring, decisions need solid foundations

The real estate sector is ever evolving. The assets involved are permanent, and your decisions impact the community and future generations. As real estate investments are capital intensive and long-term, you need to ensure you’re well-informed and confident in your plans.

To optimize your portfolio and generate sustainable value for the long-term, rely on experts who can support you from the initial strategy through all the transactional details of your real estate interests. Whether you are an individual exploring real estate investment avenues, a family-owned company reassessing your real estate interests, a private real estate entity seeking capital or partners, or you reside abroad and are looking to invest in Canada, we understand your challenges and can help you consider options to achieve your goals.

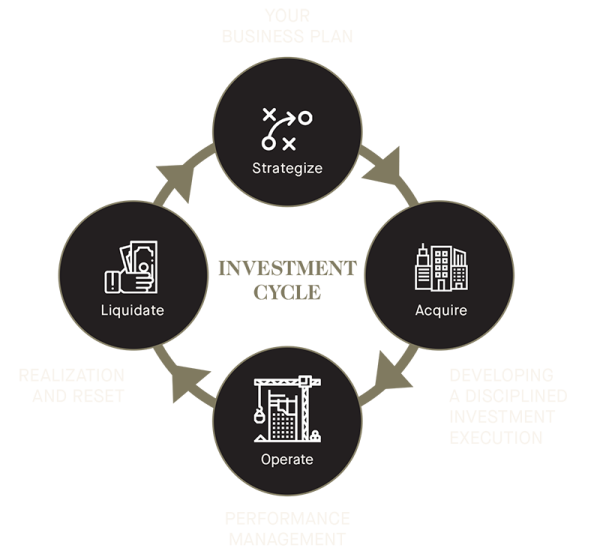

Guiding you through the investment cycle

To best assess, undertake, and manage real estate transactions, we help our clients assess financial performance in combination with sector trends and geographical dynamics. Our advisory practice is based upon the experience gained through the perspective of a sector-specific and active market participant. Our Richter experts can help strengthen your real estate planning and ensure you’re thoroughly prepared in your decision-making.

Richter serves some of Canada’s most reputable companies and notable families in their endeavors in the real estate market. We have played a part in some of the country’s most successful real estate transactions across all major asset classes and numerous high profile residential, commercial, and industrial clients have relied on our innovative approach and consistent ability to perform at the highest level, efficiently and cost-effectively.

One brick at a time we build a real estate strategy that suits your needs

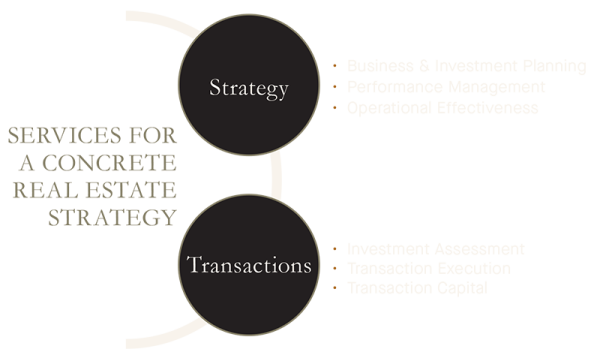

Our multi-disciplinary team of professionals have developed real estate expertise to assist with:

- Business Planning and Investment Strategy

- Investment Assessment and Capital Planning

- Structured Transaction and Negotiation

- Investment Management and Performance Benchmarking

- Investment Liquidation and Succession Planning

Our experience enables us to build an aggregate market perspective which we leverage to bring value to our clients at each step of the real estate investment cycle. We are here to help you with: