Creating Sustainable Growth as a Foundation for Succession Planning

Long-term business growth isn’t just about expansion—it’s about building sustainable enterprise value that supports both today’s operations and tomorrow’s ownership transitions. For business owners, especially in private and family enterprises, growth strategy, succession planning, and leadership continuity are deeply interconnected. Establishing a robust growth framework is one of the most effective ways to prepare a business for eventual leadership or ownership transition.

WHY EVERY BUSINESS NEEDS A LONG-TERM GROWTH PLAN

Most business owners and leaders are immersed in daily operations, often at the expense of long-term planning. Yet a formalized growth plan enables:

- Alignment across leadership, employees, and stakeholders

- Focused investment decisions that strengthen enterprise value

- Measurable tracking of progress

- A strong foundation for future leadership transitions and exit planning

“If you document a plan to establish where you want to go and what you want to achieve, it gives you the opportunity to identify challenges early, stay focused on priorities, and adapt to market changes,” explains Michael Black, Partner at Richter.

A written plan minimizes key-person risk—critical when future successors, investors, or buyers evaluate the health and resilience of your business.

UNDERSTANDING GROWTH OPTIONS: BUILDING THE RIGHT FOUNDATION

Sustainable value creation requires business owners to evaluate what type of growth aligns with their long-term goals—including succession objectives. Growth generally takes one of two forms:

- Organic Growth: Expanding revenue by adding new customers, increasing sales, or improving operational efficiency.

- Inorganic Growth: Accelerating growth through mergers, acquisitions, or strategic partnerships.

Each path offers distinct benefits and risks. Owners must assess their organization’s current capabilities, capital resources, and risk tolerance to determine the best fit. Historical growth patterns can help guide these decisions but should not dictate the future path.

Some organizations naturally gravitate toward acquisitions, while others may be better suited for steady organic expansion. The right growth strategy must also consider succession objectives—whether building transferable value for future generations or preparing for an eventual sale.

COMMUN GROWTH CHALLENGES

Without a deliberate growth plan, companies often encounter internal and external roadblocks:

- Opportunism: Chasing short-term opportunities without alignment to the long-term plan can erode focus and diminish enterprise value.

- Scaling operations: As businesses grow, existing systems, processes, and leadership structures may no longer suffice.

- Technology and automation gaps: Manual processes limit scalability and profitability.

- Culture strain: Growth can stress teams and impact engagement if not carefully managed.

- Capital constraints: Misaligned cash flow projections can limit the pace of expansion.

- Competitive threats: Market dynamics may change rapidly, impacting growth assumptions.

Through proactive planning, business owners can anticipate these challenges, mitigate risks, and position the organization for both growth and succession.

BUILDING YOUR GROWTH PLAN

Effective growth planning requires:

- Setting clear objectives: Align financial, operational, and succession goals. Consider not just revenue or profit targets, but also leadership readiness, ownership structure, and family dynamics.

- Conducting research: Evaluate internal strengths, weaknesses, and market dynamics through rigorous internal and external analysis.

- Prioritizing opportunities: Focus organizational resources on high-value initiatives while eliminating distractions.

- Developing actionable roadmaps: Translate growth priorities into specific activities, timelines, responsibilities, and resource allocations.

- Monitoring and adjusting: Continuously track progress and adjust based on execution outcomes and evolving market realities.

“We work with clients to build detailed and structured roadmaps that translate high-level vision into practical, tactical steps that are achievable,” adds Garrett Bangsboll, Vice-President at Richter.

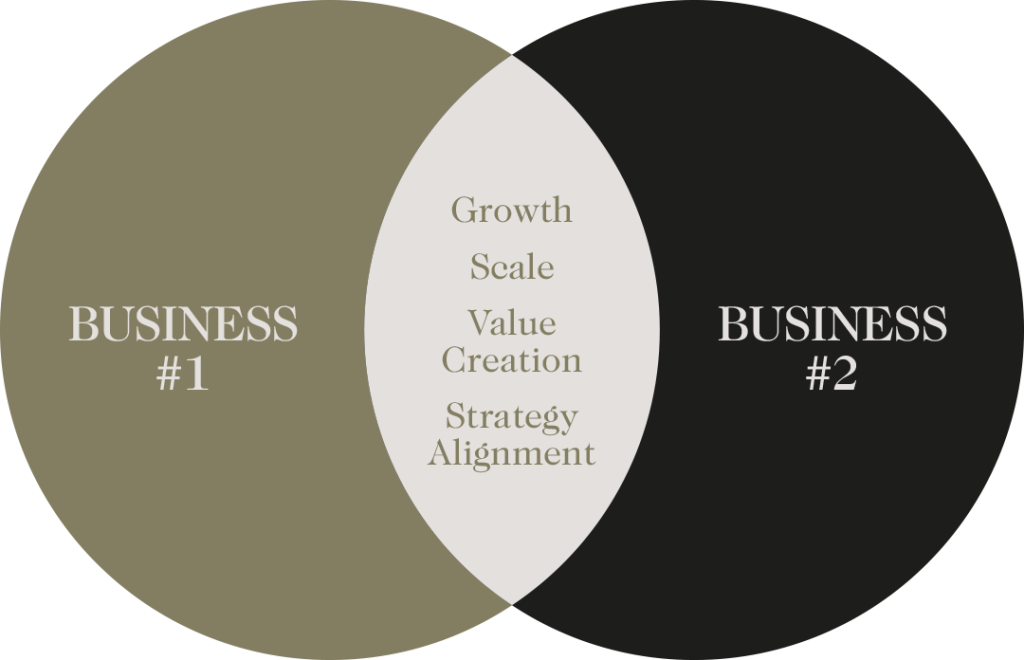

THE ROLE OF MERGERS & ACQUISITIONS IN GROWTH AND SUCCESSION

Mergers and acquisitions can be effective tools for rapidly increasing enterprise value, acquiring talent, expanding product offerings, or entering new markets. When executed strategically, M&A can serve as a valuable tactic in broader succession planning—whether by strengthening the business for future leadership or preparing it for a potential sale.

However, successful M&A requires:

- Clear deal thesis with defined objectives and outcomes

- Thorough due diligence across financial, commercial, human capital, operations, technology, or any other functional area that is critical to the deal thesis

- Post-deal integration planning

- Cultural and operational alignment

- Transparent communication with teams throughout the transition

“An integration plan shouldn’t be created after the deal closes,” says Michael Black. “Establishing post-deal structures, roles, and expectations early enables smoother integration and reduces disruption—especially when family or leadership succession is part of the long-term plan.”

For a comprehensive exploration of these considerations, refer to Richter’s article on Considerations for a Successful M&A Transaction.

GROWTH PLANNING AS A PILLAR FOR SUCCESSION

Ultimately, growth strategy and succession planning are deeply intertwined. Whether a business plans to transition to family members, management teams, or external buyers, it will be far better positioned with:

- Documented growth plans

- Scalable operations

- Strong leadership structures

- Diversified revenue streams

- Predictable cash flows

Growth planning de-risks succession by ensuring the business remains resilient and valuable long after the original owner steps aside.

“When long-term growth planning and succession objectives are aligned early, owners maintain control over timing, transition options, and the legacy they wish to leave,” summarizes Michael Black.

HOW RICHTER SUPPORTS BUSINESS OWNERS

At Richter, we guide business owners through the full spectrum of growth strategy, value creation, and succession planning. Our integrated advisory model helps:

- Define long-term business and ownership objectives

- Build formalized growth and value-creation plans

- Prepare leadership teams for evolving responsibilities

- Position businesses for smooth ownership transitions

By aligning growth planning with succession preparation, business owners protect the value they’ve built, secure their family’s financial future, and ensure the business can thrive across generations.

Related articles

Planning the Transition of Your Family Business:Four key pillars to preserve your entrepreneurial legacy

The Power of Long-Term Strategies for Business Owners

Strategic Planning: Charting Your Path to Success