Strategic Planning: Charting Your Path to Success

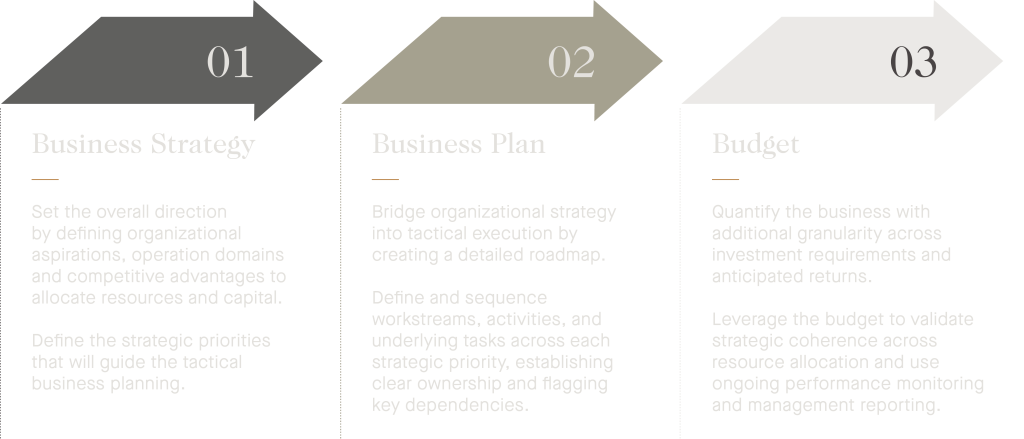

Crafting a long-term strategy is powerful. Translating that strategy into an actionable business plan is critical for achieving an owner’s objectives and ultimately ensuring business continuity and succession readiness. Together, a clear strategy, business plan, and budget not only define organizational direction but also serve as a foundation for business transition planning, enterprise value optimization, and leadership succession.

However, many business owners struggle with formalizing their ideas and strategies.

“Most owners we encounter have incredible vision and a strong sense of direction, but often lack a formalized plan that the entire organization can execute against,” says Brett Miller, Partner at Richter. “We help business owners by providing them with a structured roadmap, enabling clarity and alignment across the business and family stakeholders.”

For family businesses, where key management and decision-makers often hold deep institutional knowledge, not documenting that knowledge increases reliance on individuals, elevates key-person risk, and can reduce enterprise value—especially when considering a potential leadership transition or ownership succession.

Strategy: Take the Long View

A well-defined business strategy sets the overarching direction for the organization while proactively addressing an evolving market landscape. Without it, businesses risk being sidetracked by reactive, short-term decisions that dilute enterprise value and hinder succession options.

Determine the Destination

Organizations should establish both financial and non-financial objectives that reflect not only growth ambitions but also ownership goals, whether related to wealth creation, exit planning, or intergenerational wealth transfer. In private enterprises, ensuring alignment between business and family priorities creates lasting value for all stakeholders.

Objectives may include metrics such as revenue, profitability, market share, customer loyalty, employee engagement, sustainability, and brand reputation. Succession planning objectives should also be integrated, ensuring the business is positioned to transition smoothly to the next generation of leadership or ownership.

“Without having a clear objective for what the business becomes in 5-10 years, business owners are stuck accepting whatever comes their way and are not in command of their own destiny” says Michael Black, Partner at Richter. “Canadians build great businesses but sometimes become complacent with our vision and ambition. When a succession event arises, this can lead to misaligned expectations and impact the available options.”

Do the Research

Sound strategic decisions are informed by robust internal and external analysis. Internal assessments identify organizational strengths and weaknesses, while external market research provides an objective lens to validate assumptions and uncover opportunities or threats.

Comprehensive analysis is especially valuable when preparing for succession, as it highlights where future leaders must focus to sustain competitive advantage, and where the business must evolve to remain attractive to potential successors or external buyers.

Prioritize & Make Tough Decisions

An effective strategy clarifies not only what the business will pursue, but also what it will forgo. Prioritization ensures limited resources are focused on initiatives that strengthen the business and position it for successful ownership transition. This discipline is critical for business continuity planning and enterprise value optimization.

Benefits of a Business Strategy:

- Establish clear objectives and priorities for growth and succession.

- Validate assumptions to support fact-based decision-making.

- Create alignment across owners, management, employees, and future leadership.

- Support enterprise value creation, a key factor in exit planning.

Business Planning: Make it Tactical

A strong strategy must translate into clear tactical execution. This is where organizational buy-in, detailed planning, and accountability become critical.

“A business plan is what helps bridge the organizational strategy into tactical execution,” explains Garrett Bangsboll, Vice-President at Richter.

Engage the Business

Stakeholder engagement during business planning promotes organizational alignment, ensuring that strategic priorities resonate at all levels and that execution challenges are identified early—especially important when preparing for leadership transition and generational continuity.

Translate Priorities into a Roadmap

The business plan should break down strategic priorities into clear action items, resource requirements, timelines, and accountability structures. This operational roadmap empowers leadership teams in executing growth initiatives within a defined structure while creating clarity for future successors.

An effective plan should include:

- Define initiatives that correspond to the strategic objectives.

- Detailed action items for each strategic initiative.

- Timing, milestones, and sequencing

- Accountability and role clarity

- Financial and resource planning

- Key performance indicators (KPIs)

- Risk assessments and mitigation strategies

- Communication and change management plans

- Review cadence for ongoing monitoring

Watch the details, but don’t get caught in the weeds

While rigor is essential, overcomplicating the planning process can hinder execution. Business plans should empower teams, clarify responsibilities, and provide a pragmatic framework for ongoing evaluation—especially as leadership responsibilities begin to shift during succession preparation.

Benefits of a Business Plan:

- Operationalize the strategy into daily execution.

- Strengthen organizational alignment.

- Provide clarity and accountability for managers and future leadership.

- Enable smoother transition as roles evolve.

Budgeting: Quantify & Monitor

Many businesses confuse budgeting with strategic or business planning. In reality, a budget is the financial expression of strategic and operational decisions, providing visibility into investment needs, revenue forecasts, and capital requirements—particularly important when planning for ownership transition.

Quantify & Validate

A well-structured budget supports assumption-driven modeling across business units, products, and revenue streams. It validates whether the strategic plan is financially feasible and sustainable—a critical step when assessing transition options, ownership buyouts, or capital restructuring.

“The best budgets go beyond the income statement and incorporate fully integrated models that assess profitability, liquidity, and balance sheet health,” says Karen Kimel, Partner at Richter. “This approach highlights where additional financial capacity may be required to execute growth or succession plans.”

Monitor & Report

Budgets also serve as accountability mechanisms, allowing for active monitoring of both financial and operational progress. As succession plans unfold, structured reporting ensures that business performance remains on track and that emerging leaders are equipped to take on greater responsibility.

Benefits of a Budget:

- Quantify resource needs for growth and succession.

- Serve as an accountability framework.

- Enable proactive performance monitoring.

What’s Next?

At Richter, we recognize that comprehensive strategic planning serves not only as a growth catalyst but as a critical building block for succession readiness, business continuity, and intergenerational wealth transfer. Formalizing strategy, business planning, and budgeting allows owners to create value while positioning their organization for future transition—whether to family, management, or external buyers.

Our team works closely with business owners to assess existing processes, strengthen planning frameworks, and ensure alignment between business growth strategies and long-term ownership objectives. These efforts are essential steps in preparing the business to thrive across generations and safeguard the legacy owners have built.