COVID-19: Canada Emergency Wage Subsidy: Program Summary Table

Published on 06/08/2020

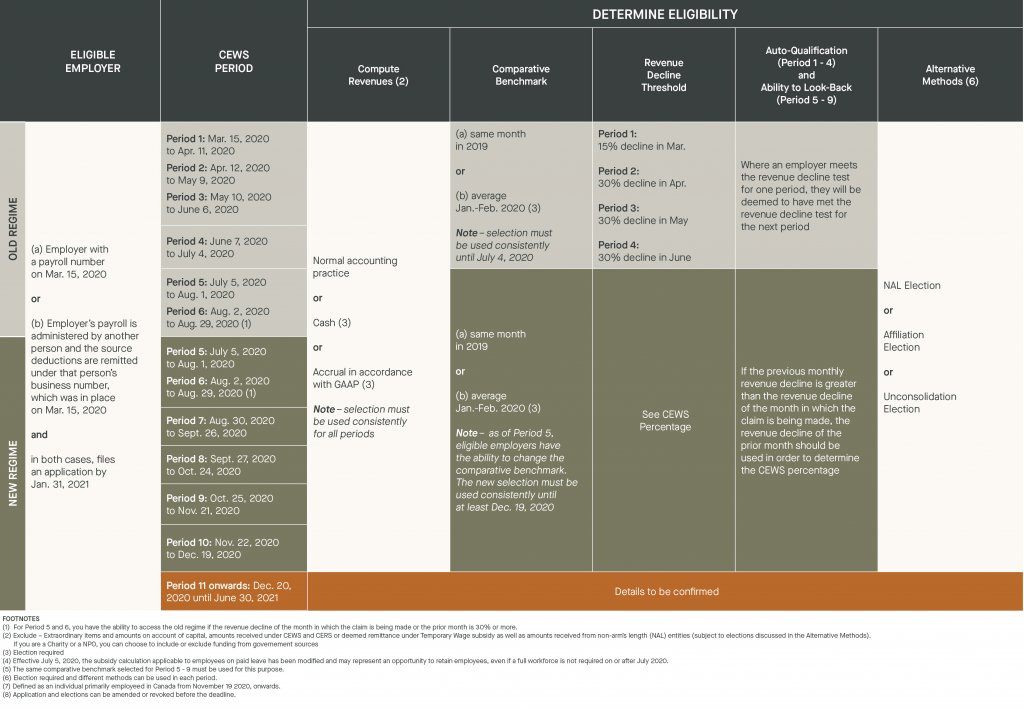

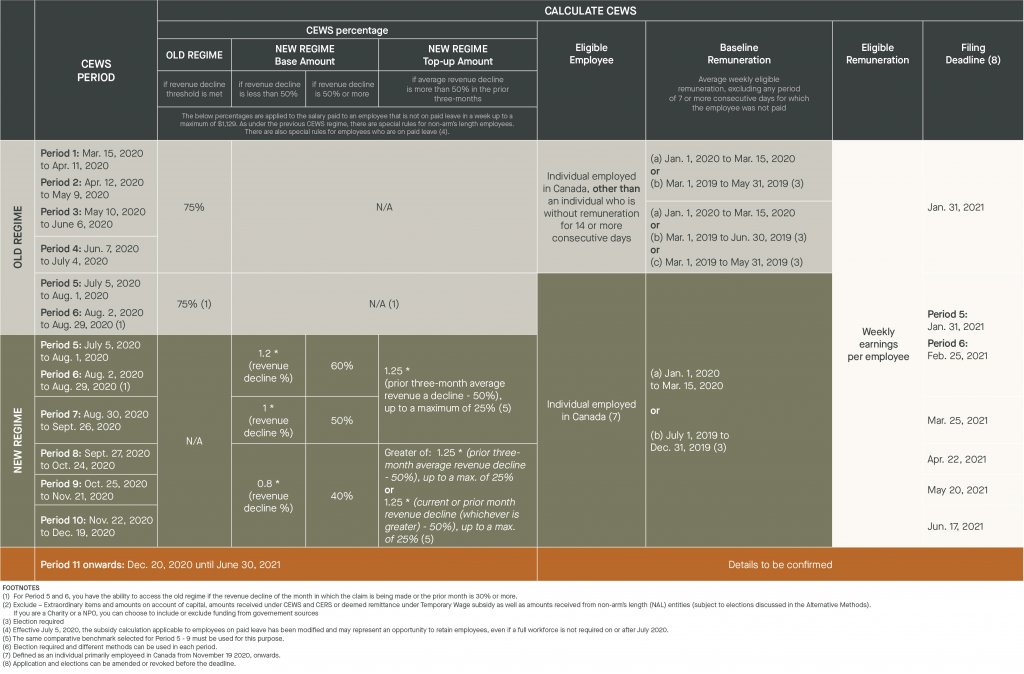

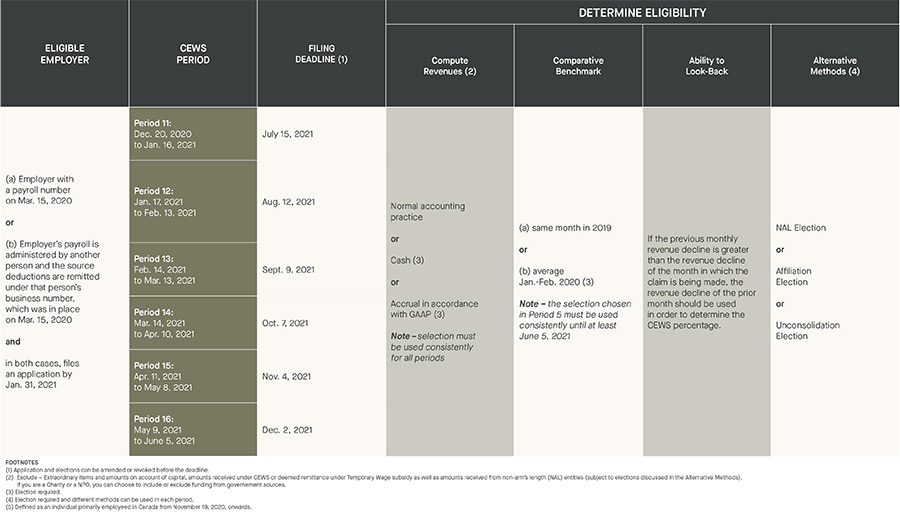

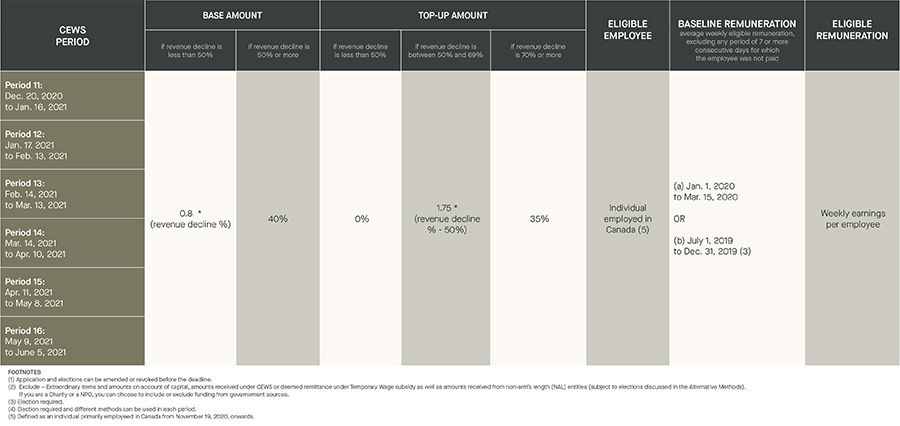

We have prepared a table to assist you in navigating the old and new rules, determining eligibility and calculating CEWS. Due to the complex nature of these rules, readers are urged to seek out their Richter professionals so that their impact can be properly evaluated and that their revenue decline analysis and wage subsidy calculations can be properly determined.

CEWS (Periods 1 – 10)

CEWS (Periods 11 – 16)

See the following decision tree which is applicable for Periods 1 to 4.