Managing Commodity Taxes and Cash Flows in a Transaction

You have just finalized the terms and conditions for the sale or acquisition of a business. The parties have agreed that a sale and purchase of assets would be better than a sale of the shares.

You now need to consider a whole range of factors, such as financing, sale price adjustments, employee transfers under the new ownership, representations and warranties regarding goodwill and traffic, non-competition clauses, etc.

On the transaction closing date, a colleague asks you THE crucial question: “Do GST and QST apply to the transaction?” So, what’s the story?

Basic Rules

The supply of goods and services in Canada/Quebec is subject to GST and QST. The purchaser may be entitled to recover both taxes through a federal input tax credit (“ITC”) or Quebec input tax refund (“ITR”).

However, it can take a number of months between the time the purchaser pays the commodity taxes to the vendor and the time the purchaser receives the refund. Given the large sums involved, this can have a negative impact on the purchaser’s cash flows.

Possible Solutions

The Excise Tax Act (“ETA”) and the Québec Sales Tax Act (“QSTA”) contain some elections and options to minimize the adverse effect of commodity taxes on cash flows summarized as follows:

- Election under sections 167 ETA and 75 QSTA on supply of assets of business

2. Election under sections 156 ETA and 334 QSTA on transactions between closely related parties

3. Option of financing taxes

However, certain conditions must be met as explained below.

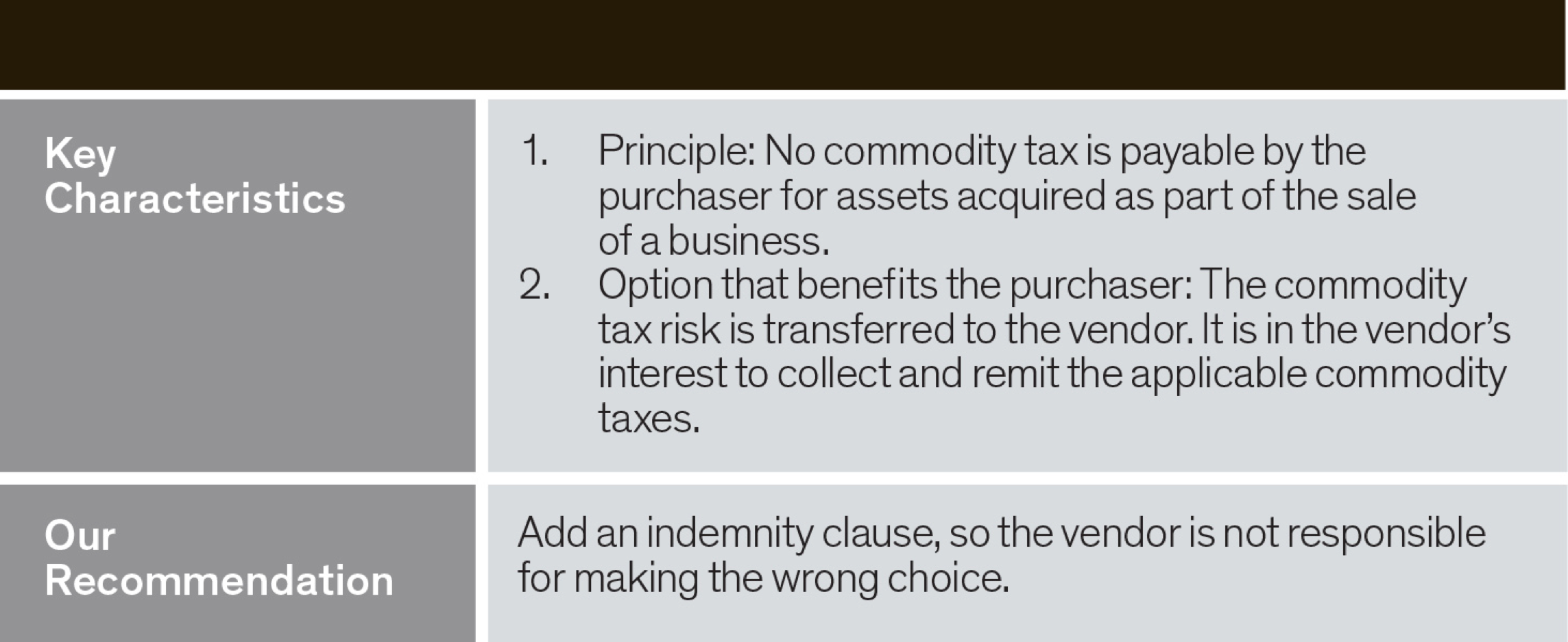

1. Election under sections 167 ETA and 75 QSTA on supply of assets of business

This election is only possible if the requirements under the ETA and QSTA are met. Among other things, the vendor must supply all or substantially all (defined to be greater than or equal to 90%) of a business it has established, operated or acquired after another person has acquired or operated it, and the purchaser must acquire all or substantially all of the property that can reasonably be considered necessary to operate the business or the part of the business involved.

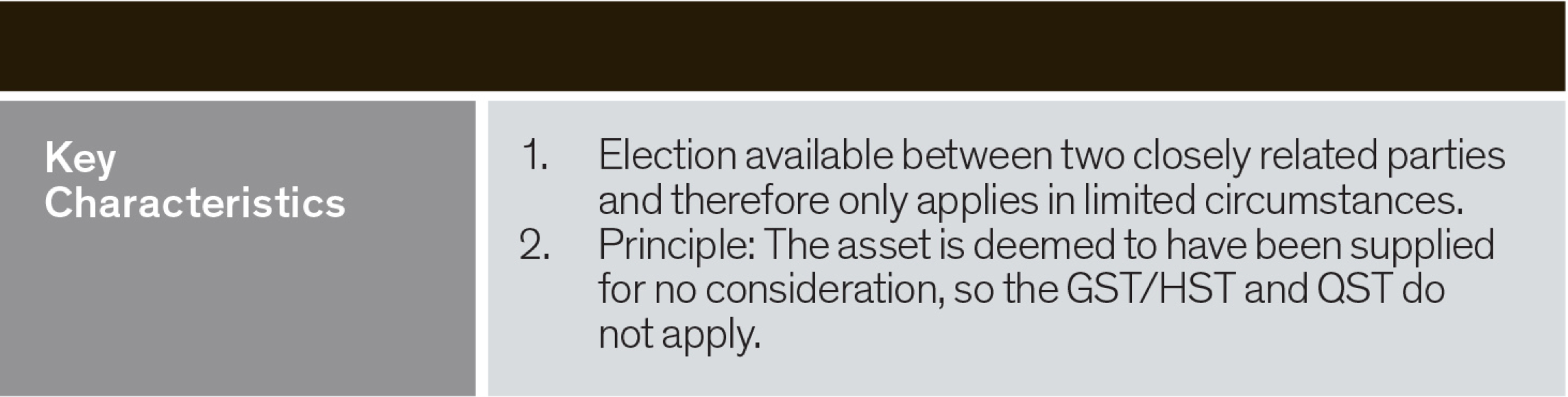

2. Election under sections 156 ETA and 334 QSTA on transactions between closely related parties

Certain conditions must be met for this election to be possible. Among other things, the purchaser must either:

1) Own property (other than financial instruments and goods of a nominal value) and all or substantially all of its property has to be used exclusively in the course of its commercial activities;

2) Have made supplies and all or substantially all of the supplies made are taxable supplies;

3) If it has no property and did not make any supply, it is reasonable to expect that a) it will be making supplies throughout the next 12 months, b) all or substantially all these supplies will be taxable supplies and c) all or substantially all of the property to be manufactured, imported or acquired within the next 12 months will be exclusively for consumption or use in the course of its commercial activities.

These conditions can be problematic when the assets are transferred to a Newco in the course of a multi-step reorganization.

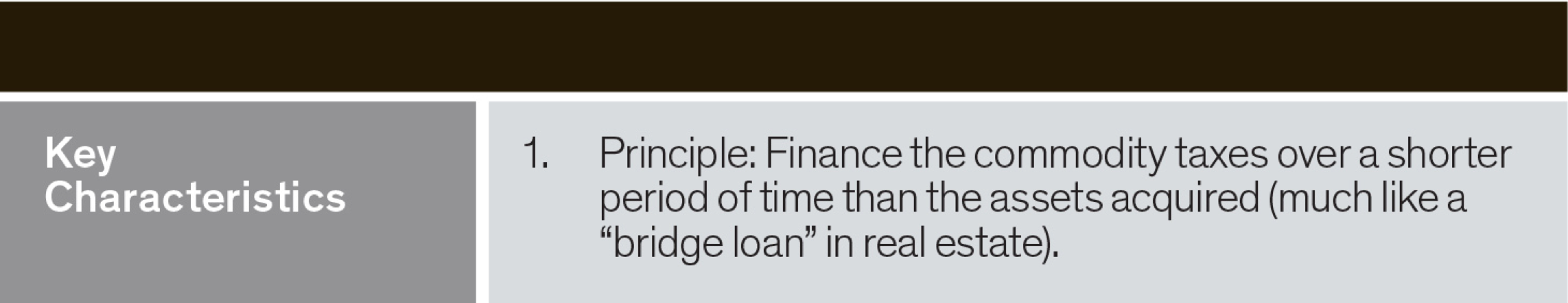

3. Option of Financing Taxes

Should the parties prove unable to agree on the time when the commodity taxes become payable or insist that a transaction must take place at the end rather than the beginning of a month (e.g. December 31st), a purchaser with a tight cash flow might be obliged to finance the commodity taxes payable on the assets acquired.

However, the purchaser should not automatically assume that the taxes payable should be added to the amount to be financed for the transaction. It would be in the purchaser’s interest (no pun intended) to finance the commodity taxes, if necessary, over a shorter period of time than the assets acquired to coincide with the expected receipt of the ITC and ITR. The purchaser would then be able to repay the entire loan related to the commodity taxes as soon as the refunds are issued by the tax authorities. This short-term loan (comparable to a “bridge loan” in real estate) is another way for the purchaser to minimize the adverse effect of the purchase on cash flows.

Conclusion

There clearly are solutions to minimizing the impact of commodity taxes on cash flows in an asset transaction. As is often the case in taxation, it’s better to anticipate the problem and solve it at the negotiation stage, not when the transaction is final.