The benefits of cost audits

According to the “Pulse of the Internal Audit 2020” published by the Institute of Internal Auditors (IIA),[1] one of the main risks not covered in internal audit plans is the reduction of costs and expenses.

Indeed, according to the survey, about 2/3 of the surveyed organizations do not include this risk in their annual audit plan. However, in the context of this economic slowdown, companies are now more than ever in need of liquidity. Wouldn’t it be a good idea to add this topic to the audit plan?

Where to start? What are the main risks covered in a cost audit?

Costs are an important part of a company’s performance. Sound management of these costs is an indicator of better financial health of a company. A cost audit provides reasonable assurance that the costs as recorded are necessary, legitimate, accurate and in compliance with the organization’s internal policies and procedures. The following risks should be considered when performing a cost audit:

- Unnecessary expenditures;

- Expenditures not related to an existing contractual agreement or project;

- Unauthorized expenditures;

- Expenses recorded inaccurately (incorrect account, amount or period);

- Expenditures not supported by adequate documentation;

- Fictitious expenses;

- Illegitimate expenditures based on the policies and procedures in place.

Three benefits of a cost audit

A cost audit not only provides reasonable assurance that the costs that are recorded are required and appropriate, but also provides assurance that the accounting treatment follows prescribed principles, standards, policies and procedures. Senior management is therefore better equipped to make necessary decisions with the most accurate information in hand.

In addition, a cost audit can also result in significant savings through the identification of situations where expenditures are not required, are irrelevant or can be deferred. Such an audit can also identify errors, non-compliance and even attempted fraud!

Finally, another benefit can be the improvement of the company’s financial performance through better cost management resulting from audit recommendations.

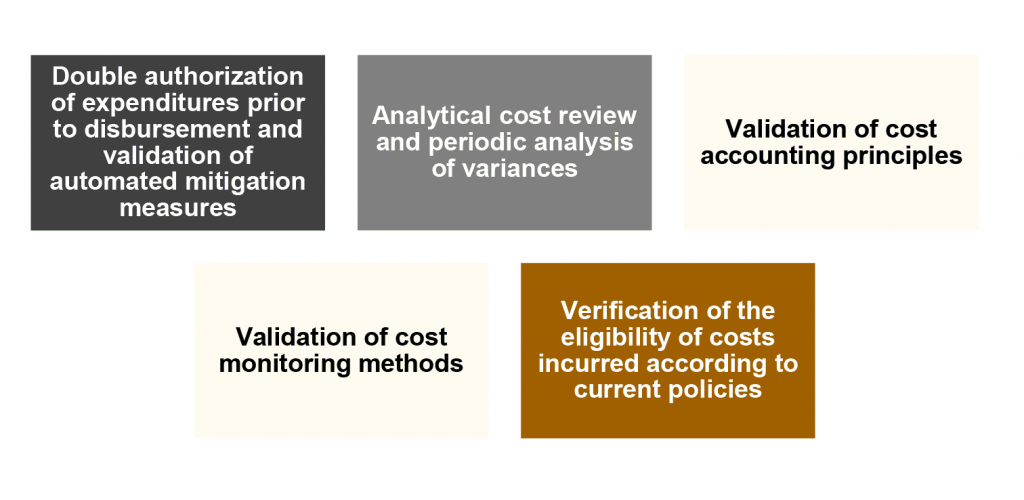

The top five best internal controls for effective cost management

Cost management is one of the key factors in empowering organizations to maintain long-term financial health. The internal audit functions have an opportunity to play a key role in achieving this organizational objective and can highlight certain shortcomings to uncover business process improvements. If your audit plan does not yet contain this type of mandate, it is time to make some changes!

How can Richter help you?

- Risk assessment related to cost management;

- Development of audit programs and risk and control matrices;

- Assessment of the adequacy of controls in place and comparison with best practices;

- Development of action plans;

- Evaluation of the cost management structure and methods in place as well as recommendations to better adapt them to the needs of your organization;

- Training/workshops with your organization.

[1] https://dl.theiia.org/AECPublic/2020-0118-CAE-2020-Pulse-Report-FNLonline.pdf