The Hidden Cost of Working with Too Many Advisors: How Integrated Guidance Transformed One Family Enterprise

“I still remember the book they gave me when I was a kid. I didn’t know then how much that moment would matter.”

It was a one-time meeting he accompanied his father to as a young child that unknowingly made an impression on this client. Decades later, he returned to Richter, now the leader of his family’s business. However, the years of running the family business and managing intergenerational dynamics were weighing on him.

He was overwhelmed and under pressure; in the midst of closing a $80M real estate deal. Unsure of where to turn and uncertain of whether or not Richter’s client-centric promise was real, this business owner reached out needing strategic guidance with a single transaction. He wanted to start slowly, knowing that changing his business or financial advisory team mid-deal would be very disruptive. That’s where it started: no pressure, no disruption, just help where he needed it.

“Why Am I Doing This Alone?”

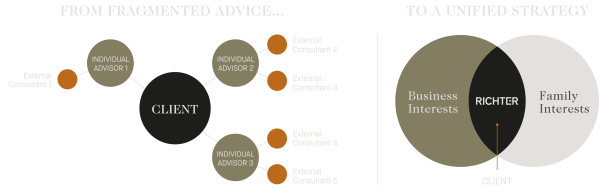

Like many individuals of significant means, this client was facing a common but serious challenge: his business and personal advisors were working in silos. There were too many advisors and not enough advice, he felt like he was shouldering everything on his own. No one was talking to each other, so items like estate questions lingered, and investment strategies lacked cohesion. At one of the most stressful moments during this major real estate purchase, he was feeling isolated, waiting for answers that came too late.

“There was no one person or specific team I could turn to,” he shared. “Every advisor had a piece of the puzzle, but no one could see the full picture.” That’s when he saw a video which outlined Richter’s approach and was curious to see if the unique Business | Family Office model could deliver.

After meeting with Richter, a shift happened. “We didn’t push the situation into a full engagement, we just listened,” says Richter partner and strategist, Joe Triolo. “He didn’t want full disruption mid-transaction, so we provided business acquisition support and merger due diligence.” This small step built trust.

The turning point came when a financial discrepancy was uncovered. The client discovered that a significant amount of money was left unaccounted for by a previous firm. The team worked efficiently to identify gaps and realign his financial roadmap. “It wasn’t just about fixing the problem, it was about restoring peace of mind,” says Triolo.

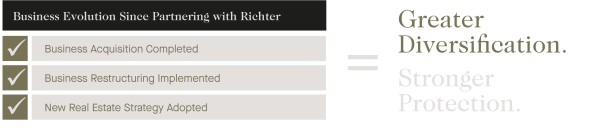

Following this, Richter’s advisors facilitated portfolio diversification and real estate strategy, analyzing whether to sell or lease a longstanding family building, a decision tied to both financial implications and emotional value.

“Is growth worth the stress?”

“He wanted to scale thoughtfully but lacked the professional support to truly grow. Richter empowered him to take his business to the next level; it’s where our support became transformative,” says Triolo.

Richter assisted with a company restructuring, developing an organizational structure aligned with future expansion and included plans for upcoming acquisitions. On the personal side, investment strategies that balanced growth with risk mitigation were also introduced and brought further stability to his real estate-heavy portfolio while opening new avenues for long-term wealth generation.

For Richter partner Bill McLean, who specializes in business family transitions, this further emphasized the personal nature in the work being done: a business painstakingly built over years and years by a father, now in the hands of next generation leadership and all of the feelings of responsibility that come with this. “This wasn’t just about being a business advisor. It was about ensuring a son could honour his father’s vision while still carving out his own path,” notes McLean.

“How do I keep my family at the center?”

Richter’s relationship-driven model centres on not pushing services, but rather, developing relationships. This meant the client was able to share his challenges more openly, which in turn, helped the Richter team address them in a timely fashion. Because every decision following the initial acquisition deeply tied to relationships, legacy, and future generations, the firm’s integrated Business | Family Office model resonated deeply.

The firm’s signature quarterly meetings became more than strategy sessions. They often became safe, trusted spaces to explore business goals, personal ambitions, and family concerns, usually bringing other family members to the table, too. Here they tackled issues holistically, often bringing accounting, business strategy and investment portfolio advisory experts to the table altogether; a departure from the norm wherein this would involve three or four separate conversations with separate advisors.

“It meant everything to me that I could bring my son into those meetings, just like my dad brought me,” notes the client.

The outcome? More than just numbers

In just 12 months, Richter’s advisors helped this client:

- Close a $80M building purchase.

- Reorganize the company for long-term growth.

- Develop a real estate strategy that unlocked capital.

- Diversify his family’s wealth across new asset classes.

- Build a deeper sense of control, confidence, and calm.

Most importantly, he found what he didn’t even realize he was missing: a relationship built on trust and a holistic approach to the business; one that considered every aspect of the business and helped propel the enterprise to the next level “They didn’t just help me make better business decisions. They elevated my business. And above all, they helped me sleep better at night.”

If your current support feels fragmented or if you’re carrying the stress of managing a family enterprise alone, you’re not alone. Our Business | Family Office platform was built to navigate complexity.

If your business and your family are deeply connected, you deserve advisors who understand both.

Learn how Richter’s Business | Family Office platform can help.

Creating And Managing Your Wealth

Since inception, we have been driven by independence and objectivity. We are not beholden to one investment solution or limited by the number of investment opportunities available to us.

How Do You Navigate a Family Business in Crisis Without Losing Everything?

Accelerating International Growth: Expanding a Business into Canada