De-Risking the Mindset, Post-Sale

HOW A MENTAL SHIFT IS NEEDED TO ESTABLISH A SUCCESSFUL INVESTMENT STRATEGY

The sale of a business is an exciting time of course; and this significant inflection point requires a lot of attention to everything from the financial elements to proper tax and estate planning. But while the steps of the transaction itself may be ‘business as usual,’ few entrepreneurs are really prepared to navigate the phase of their life post-sale. Even though it’s an anticipated moment, retirement after the sale of a business presents a big shift for an entrepreneur, and the next stage can be quite difficult to process mentally and emotionally.

For many entrepreneurs, they’ve had years – if not decades – of being the one in control of building the business on their own terms and having great agency over its broad outcomes. Come sale time, this all begins to transition. While on the one hand the sale of the business means unlocking a pool of capital and a new level of freedom for the entrepreneur to retire on their own terms and maintain a lifestyle in which they’ve become accustomed; on the other, the level of control, insight, and influence which the entrepreneur has become accustomed changes dramatically.

It’s a major shift in one’s personal identity to no longer be the Business Owner. It’s common that for years the entrepreneur would self-identify through the business as if one and the same, given that it’s likely been at the core of who they are (now, were) for most of their adult life. After a sale, many don’t anticipate the feelings of ‘who am I’?

SHIFTING PERSPECTIVES

The business world has a certain level of survivorship bias. Every successful entrepreneur has become successful despite making mistakes. However, at the end of the day, successful entrepreneurs stand tall on their latest and greatest success – selling the business for a considerable sum. This creates a recency bias; the entrepreneur believes that the same methods and tactics they once used to build a successful business should also be applied to managing their wealth. While this confidence can be applauded, this situation needs to be addressed, as there is a much different approach to risk when building a business versus when constructing a portfolio.

The challenge for business owners post-sale is whether to apply this unrecognized hubris to their investment landscape, which would draw on how they found success as an entrepreneur. This is especially tempting for entrepreneurs in the tech field. Having what they believe is unique access and insights into the technology space, it’s only natural that they would want to jump right back into this ecosystem; to reinvest in what they already know. This though, is where it’s crucial to first take a step back and look at the needs and goals of the family; to de-risk their portfolio to ensure they can carry on in the manner in which they wish to live.

The entrepreneur might not see the immediate benefit in managing risk in this fashion, but while any idiosyncratic risk could be successful, it could also fail miserably. Entrepreneurs must understand the utility of de-risking their financial wealth in order to live their current lifestyles for the rest of their lives. In other words, in order to build wealth, one must concentrate capital, in order to preserve wealth, one must diversify. The first step to portfolio construction is right-sizing allocations and building pools of capital that will have different usages for a family. Enter, the goals-based investment approach.

THE GOALS-BASED INVESTMENT APPROACH

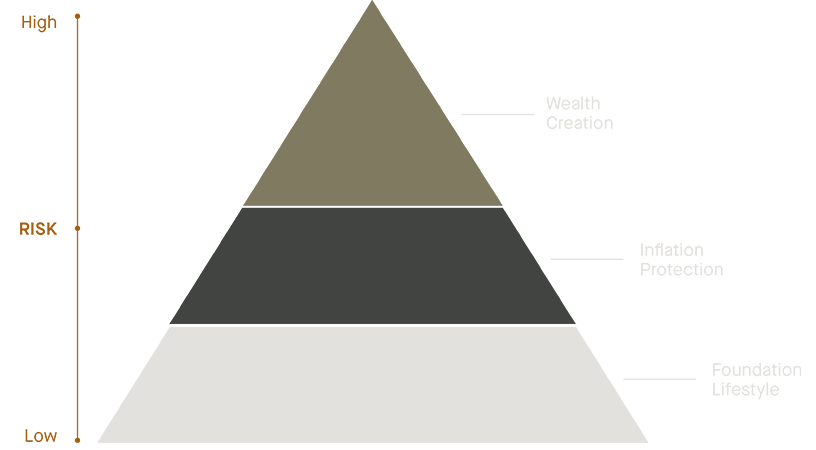

The pyramid shows that all families have foundational requirements such as a basic need for safety and liquidity, which means always having the right insurance policy and a certain amount of liquid assets. This need is best achieved via investing in low-risk assets. The returns generated and size of the capital pool may be low, but this segment is needed for utility, and is a necessary foundational layer in the construction of a family’s portfolio.

The next step is protecting against inflation – providing returns to maintain the spending power of the family. This may come in the form of real estate, stocks, or high yield bonds, and comes with a medium amount of risk. These assets are designed to help grow a portfolio beyond the rate of inflation, an important function in one’s portfolio.

Finally, comes the aspirational bucket, the high-risk, high-reward-type of investments in this bucket seek superior returns through higher risk and possibly illiquidity. Families seek to grow their capital base to offset the dilution of wealth through the generations and/or to be able to share more wealth with society. The assets situated in the high-risk category are those most like the assets that the entrepreneur once had control over and now this control must be relinquished to the markets and portfolio advisors. If the majority of a family’s portfolio was left in this bucket and the markets encountered an economic or political event, there would be little to no cushion in the portfolio to be able to withstand the fallout of such an event. The entrepreneur’s risk-based mindset must be upended to ensure this doesn’t happen. It’s this shift in thinking and relinquishing of control that is necessary in order to protect the family, their wealth, and their legacy.

Helping entrepreneurs prepare for what can be obvious challenges in a sale is one thing, but it takes a special advisor to recognize some of the unforeseen challenges and be able to support the entrepreneur throughout the journey ahead, to guide them in crafting a unique, goals-based investment portfolio able to support their lifestyle and foster a legacy of wealth-building for generations to come.