Labour Challenges in the Food Industry: 2025 Insights

As the North American food industry navigates a landscape marked by economic headwinds, shifting consumer preferences, and geopolitical disruptions, Richter’s 2025 Food Sector Study offers a sobering yet insightful look into the state of human capital. Drawing on responses from 150+ executives across privately held food manufacturing, processing, wholesale, and distribution companies, the study reveals a sector under pressure and a workforce strategy in flux.

Labour Sentiment: A Sharp Decline in Confidence

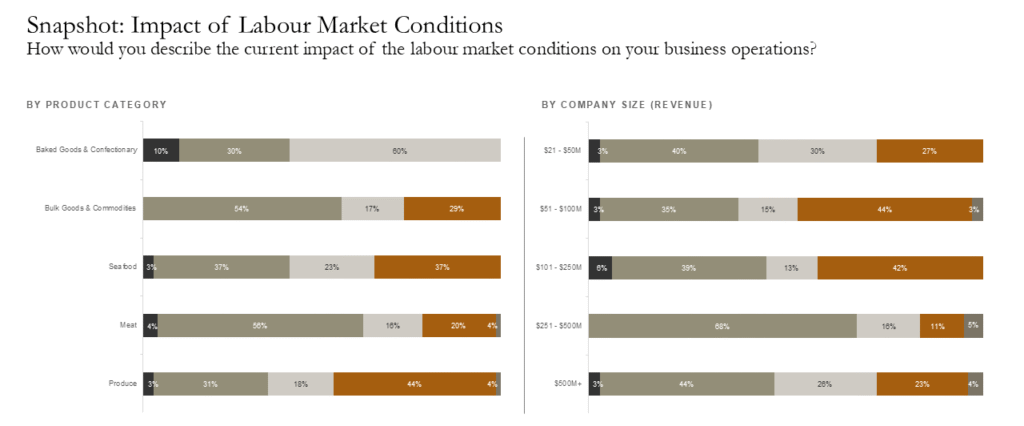

The most immediate signal of distress is the deterioration in labour market sentiment. In 2024, only 24% of respondents described conditions as negative. By 2025, that share has nearly doubled to 46% and just 6% of US businesses report any positive outlook on labour availability or quality Canadian businesses fared better, with 51% reporting positive impacts, though this represents from previous years.

The Meat category was the hardest hit market segment, with 60% of businesses reporting adverse labour conditions as the segment reacts to volatile global protein market dynamics. Contrary to labour market sentiment across the broader economy, food companies in the upper middle market – with $251–500M revenue – reported more significant labour challenges than smaller companies.

Workforce Adjustments: Expansion Amid Uncertainty

Despite the negative market sentiment, many companies are expanding their workforce. The study shows that 40% of respondents reported workforce expansion. However, the market sentiment is far from consistent, with 33% of companies reporting workforce reductions and the rest indicating no change.

This mixed response reflects the sector’s bifurcation: companies with strong market positioning or narrow product focus are investing in talent, while others are retrenching due to cost pressures and operational inefficiencies.

Talent Strategy: Attraction, Training, and Retention Challenges

The study highlights growing difficulty in attracting, training, and retaining talent:

- Attracting Talent: An ongoing challenge, as 44% of operators found attracting talent difficult, with only 11% describing hiring as relatively simple.

- Training Talent: A steep drop in optimism, as only 8% found it easy to train staff, down from 68% last year.

- Retaining Talent: Improvement in retention appears paused, as just 1% reported year-over-year (YoY) improvement in their ability to retain talent, compared to 39% in 2024.

These figures suggest that the sector is facing a systemic talent crisis. The decline in training and retention effectiveness points to deeper issues in workforce engagement, onboarding, and career development. As the sector continues to navigate an aging workforce and lingering uncertainty around the impact of immigration policy changes on immigrant workers, effective talent-attraction strategies will become a key point of differentiation.

Strategic Shifts in Workforce Models

In response to these challenges, companies are rethinking their operating models. A significant population – 71% of respondents – reported either moderate or significant shifts in how labour is used. The top areas of change include:

- Outsourcing & Contracting Work (28%)

- Reskilling & Retraining Existing Workforce (22%)

- Automation & Technology Investment (20%)

- Role Consolidation (19%)

- Leadership & Succession Planning (9%)

These shifts reflect a move toward leaner, more flexible workforce structures and compensation models, alongside greater investment in technology and retraining to offset labour shortages and improve productivity. As companies adopt more part-time or seasonal roles, they must balance solutions that address immediate labour needs with long-term workplace appeal rooted in stability and career growth. More broadly, there is a growing recognition that the human capital approaches and talent incentivization models that worked in the past no longer reflect today’s market realities.

Labour Challenges Ahead: Turnover and Output Dominate

Looking ahead, the top labour challenges identified for the next 1 to 3 years are:

- Employee Turnover (22%)

- Employee Output / Productivity (19%)

- Wage Expectations (16%)

- Candidate Skills & Capabilities (15%)

Onboarding and hiring availability remain key challenge today, but expectations are more optimistic for the years ahead. With this issue declining as a forward-looking concern, companies appear increasingly focused on optimizing existing teams rather than expanding headcount.

Human Capital as a Strategic Imperative

Richter’s 2025 study paints a clear picture: human capital is no longer a back-office concern but a strategic imperative. Companies that treat talent as a core asset are adapting faster and more effectively to market disruptions. Whether through automation, retraining, or leadership development, the companies that will lead this sector are the ones investing in their people as much as in their products.

How is human capital driving your business forward? Discover Richter’s full 2025 Food Sector Study to dive deeper into the trends, challenges, and opportunities shaping the sector.

Human Capital Services

Human capital is one of the cornerstones of an organization’s success, and employees are one of the most essential sources for generating added value.

Compensation advisory

At Richter, we understand that as private and often family-owned business owners, you may have concerns around employee share ownership or similar plans including phantom equity, stock appreciation rights (SAR), employee-ownership trust, stock option plans or otherwise.

M&A Lookback on the North American Food Sector 2024

M&A activity in the North American food sector exhibited fluctuations between 2018 to 2024, with notable trends in both deal count and transaction value. A significant surge in 2021 was driven by a post-pandemic recovery as companies sought growth opportunities. However, the market experienced a slight slowdown from 2022 onward, influenced by macroeconomic factors such as inflation and rising interest rates.

The 2025 North American Food Sector Study: Navigating Shifts in Confidence, Costs, and Talent

Explore the evolving dynamics of the food sector in the 2025 North American Food Sector Study, addressing tariffs, labour, M&A appetite, and succession planning with resilience and adaptability.

Understanding the Dynamics of the Food Industry: Trends, Challenges, and Opportunities Ahead

Explore the evolving food industry with Richter’s North American Food Sector Studies, revealing key trends, macroeconomic conditions, growth projections, and strategic priorities.