The Richter Economic Timeline: What was known or knowable and what did the market say?

The Richter Economic Timeline

Sources: Available upon request

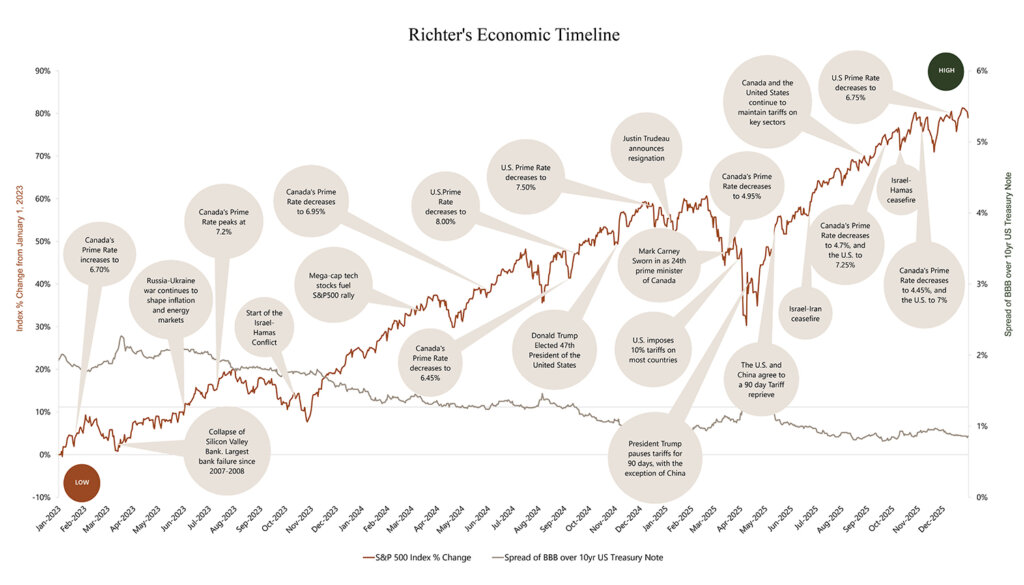

Richter’s economic timeline plots local and world events together with a depiction of the volatility of the stock market (S&P 500) and credit markets (the spread of publicly traded BBB corporate bonds over U.S. treasury notes).

After the sharp Q1 2025 market decline and a strong rebound in Q2 resulting from changing trade-related sentiments, U.S. equities continued their ascent in Q3 and Q4. Equity markets reached record highs as easing inflation, resilient earnings, and clearer central bank policies supported investor sentiments despite ongoing geopolitical and trade-related uncertainties. This occurred contemporaneously with the following:

- The Federal Reserve continued easing in Q4, cutting rates by 25 bps in October and again by 25 basis points (bps) in December. The Bank of Canada cut by 25 bps in October and then held steady in December.

- Canada’s unemployment rate moved off its earlier peak to 6.8% at the end of Q4. Meanwhile, the U.S. unemployment rate held steady at approximately 4.4% through Q4.

- Canada’s housing market remained soft throughout the year with benchmark home prices down 4%. Buyers remained cautious, and sellers were making price concessions heading into year-end.

- Among the innovative mega-cap tech/AI leaders (the MAG 7*), market leadership remained highly concentrated into year-end: the group returned 23% in 2025 versus 16% for the S&P 500 and accounted for roughly 46% of the index’s total return. Alphabet had the greatest return during the year, with 65.8% growth, and Nvidia posted a stock surge of 40.9%, driven by surging demand for AI chips and data-centre solutions.

- Precious metals outperformance persisted into Q4, led by gold demand from central banks and strong gains in silver, which more than offset declining oil prices and supported overall commodity performance in 2025.

- In late December 2025, Canada tightened its trade response by imposing 25% tariffs on a list of steel derivative products, adding a new layer of measures beyond the counter-tariffs already maintained on core steel and aluminum sectors.

- The Consumer Price Index (CPI) rose 2.1% on an annual average basis in 2025, following an increase of 2.4% in 2024. Prices for services remained elevated, rising 3.1% in 2025, compared with a 4.1% increase in 2024.

- Contemporaneously, concerns and uncertainties remain over the sustained military invasion of Ukraine by Russia.

- A ceasefire deal between Israel and Hamas was reached in early Q4.

*MAG 7 describes the market’s technology leaders – Microsoft, Apple, Tesla, Alphabet, Nvidia, Meta Platforms and Amazon.

This timeline was compiled by Richter Inc.’s Business Valuation and Dispute. A similar version was published in the CBV Institute’s Journal Advisory Group.

Link: https://cbvinstitute.com/wp-content/uploads/2020/11/CBV-Institute_Journal2020_Final.pdf