Planning the Transition of Your Family Business:Four key pillars to preserve your entrepreneurial legacy

Succession planning for a family business represents one of the most important considerations and milestones in the life of an entrepreneur. By carefully addressing governance, tax, and enterprise value preservation considerations, a well-structured transition ensures business continuity while protecting the family’s entrepreneurial legacy. Here, we outline the four key pillars to successfully plan and execute a sustainable and thoughtful family business succession.

Focused Succession Planning: A Natural Extension of the Entrepreneurial Journey

Building a sustainable family enterprise demands vision, resilience, and long-term commitment. As the time comes to consider the transition, the objective extends far beyond executing a transaction. It’s about honouring values, preserving relationships, and determining the path of the continuity of the family legacy.

Each situation is unique. Transition planning becomes both a strategic and deep human process, where every decision contributes to determining the legacy impact you will create.

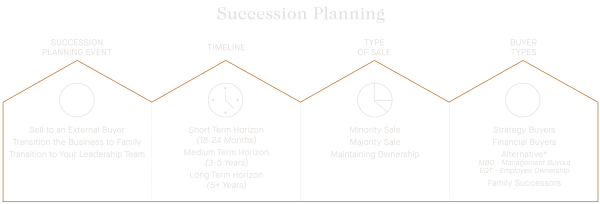

1. Identifying the Succession Path Aligned with Your Long-Term Vision

Choosing the right succession model will directly shape the future trajectory for the business.

Transition the business to family

Family governance planning provides a framework for generational continuity, clarifying roles, responsibilities, and decision-making protocols. This approach requires an honest and rigorous assessment of next-generation readiness, ensuring stability for both the family and the business over time.

Transition to your leadership team

When a strong and committed management team is already in place, gradually transitioning responsibilities becomes a natural option. A well-structured corporate governance framework will support the effective transfer of strategic and operational responsibilities while safeguarding the family’s continued interests.

Sell to an external buyer

Whether to diversify family wealth, capitalize on market opportunities, or optimize the succession structure, an external sale requires comprehensive transactional preparation. This will likely include business valuation, tax optimization, and post-transaction role planning for the active shareholders.

2. Defining the Appropriate Scope of Ownership Transition

Every entrepreneur must assess their preferred transition path based on business, ownership and family objectives.

- Maintain Ownership: Continue to provide strategic oversight while progressively transferring operational responsibilities.

- Minority Sale: Secure liquidity while maintaining control, allowing for carefully selected strategic partners.

- Majority Sale: Fully realize the accumulated value, contingent on established governance, financial structure, and organizational readiness.

3. Structuring the Transition Timeline

Timing considerations can directly influence the options for value optimization and strategic planning.

Short-Term Horizon (less than 18-24 months)

In an accelerated context, priority must be given to strengthening financial reporting, simplifying legal structures, and proactively addressing vulnerabilities identified throughout the due diligence process.

Medium-Term Horizon (2 to 5 years)

An optimal timeframe to maximize operational and family wealth value: revenue diversification, optimization of internal processes, progressive transfer of key relationships, and gradual reduction of founder dependency.

Long-Term Horizon (5+ years)

This allows the integration of more sophisticated strategies, including estate planning & trusts, management buyouts (MBOs), or the implementation of Employee Ownership Trusts (EOTs), while providing time for the emotional aspects of transition to evolve naturally.

4. Selecting the Right Successor

Successor selection directly influences the long-term sustainability of the enterprise.

- Family Successors: Ensuring intergenerational continuity through a carefully designed governance framework.

- Strategic Buyers: Industry players seeking operational synergies, often requiring careful consideration of cultural integration post-transaction.

- Financial Buyers: Family offices, private equity funds, and institutional investors focused on stable, scalable operations and growth potential.

- Alternative Structures:

- Management Buyout (MBO): Enables the existing leadership team to progressively assume ownership.

- Employee Ownership Trust (EOT): An emerging structure in Canada fostering long-term employee alignment and cultural continuity.

Your Succession Planning Checklist: The Cornerstones of a Successful Transition

- Initiate strategic discussions early;

- Strengthen governance and financial structure;

- Formalize management systems and decision-making processes;

- Engage multidisciplinary advisors across tax, transactional advisory, family governance, and legal disciplines;

- Support family members in addressing the emotional and intergenerational dimensions of transition.

The transition of a family business is far more than a transaction. It represents the culmination of an entrepreneurial vision built across generations.

At Richter, we understand that managing entrepreneurial and family complexity requires far more than transactional expertise. Through our Business and Family Office services, we guide you at every stage of the process, always respecting your history, values, and long-term family objectives.

You’ve built enduring value. Together, we’ll build its continuity.

Related articles

The Power of Long-Term Strategies for Business Owners

The Richter Family Advisory Series: Preserving Legacy and Stability

Creating Sustainable Growth as a Foundation for Succession Planning