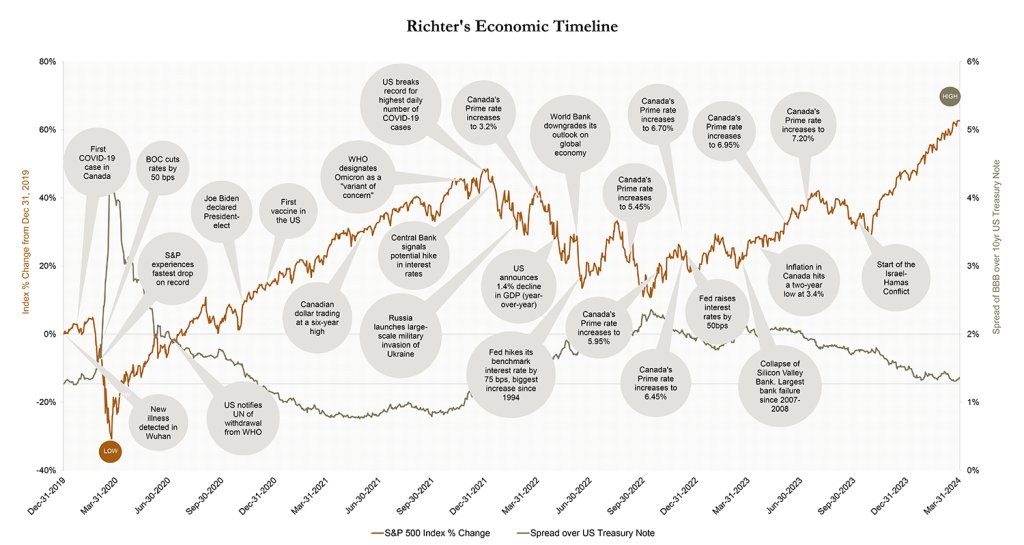

The Richter Economic Timeline: What was known or knowable and what did the market say?

Sources: Available upon request

Richter’s economic timeline plots local and world events together with a depiction of the volatility of the stock market (S&P 500) and credit markets (the spread of publicly traded BBB corporate bonds over U.S. treasury notes).

Stock markets consistently rose showing strong performance in the first quarter of 2024. The belief that central banks will relax monetary policies in the coming months has bolstered investor confidence. Overall, the sentiment in the stock market is optimistic.

During the first quarter of 2024, less inflationary pressure and possible rate cuts drove the S&P 500 to new records. Stock prices are defying fears of a recession, and many believe the economy is growing at a sustainable rate. This occurs contemporaneously with the following:

- U.S. and Canadian growth have been surprisingly resilient, but credit delinquencies still raise concerns towards a potential soft-landing recession in the U.S. and to a lesser extent in Canada.

- Unemployment rates have slightly risen in Canada and the U.S., which also suggests a softening economic backdrop amidst stock market increases.

- Innovative tech stocks (MATANA*) and the frenzy around AI has exceeded expectations in the market.

- The October 7th Israel-Hamas War has had a significant impact on gas prices, gold prices and currency exchange rates. Contemporaneously, there are continued concerns and uncertainties over the sustained military invasion of Ukraine by Russia.

- Disruptions geopolitically and environmentally have impacted global maritime trade, severely elongating the time necessary to ship cargo by sea.

- The U.S. dollar remains strong, strengthening against major currencies, despite a small drop in December 2023, bolstered by a robust economy and growing U.S. Treasury yields.

*MATANA describes the market’s technology leaders – Microsoft, Apple, Tesla, Alphabet, Nvidia and Amazon.

This timeline was compiled by Richter Inc.’s Business Valuation and Dispute. A similar version was published in the CBV Institute’s Journal Advisory Group in 2020.

Contact Person: Alana Geller, CPA, CBV, CFF, FEA