Transition and Succession Planning

Protect What You’ve Built. Plan for What’s Next.

Succession is more than a transaction—it’s a turning point. At Richter, we help you navigate this transition with intention. Whether you plan to pass the business to the next generation, transition to trusted leadership, or pursue a strategic sale, our integrated Business | Family Office model ensures your values, your vision, and your wealth stay aligned.

Here’s how we help business families move forward with clarity, alignment, and purpose:

WHAT IS YOUR SUCCESSION PLANNING EVENT?

- Sell to an External Buyer

- Transition the Business to the Family

- Transition to Your Leadership Team

WHAT IS YOUR TIMELINE?

- Short Term Horizon

- Medium Term Horizon

- Long Term Horizon

WHICH TYPE OF SALE?

- Minority Sale

- Majority Sale

- Maintaining Ownership

WHO ARE THE POTENTIAL BUYERS?

- Strategic Buyers

- Financial Buyers

- Family Successors

Expert Insights at Your Fingertips

Discover more insights

Planning the Transition of Your Family Business:Four key pillars to preserve your entrepreneurial legacy

Strategic Planning: Charting Your Path to Success

The Richter Family Advisory Series: When a Non-Family CEO is in Charge

The Succession Webinar Series

Watch On-Demand Webinars

- Shaping the Future Without Disrupting the Present

- Keep or Sell the Family Business

- From Plan to Legacy: How the Right Structure and People Drive Successful Succession

- Private Company Compensation

- Financial Readiness: Establishing Structures that Keep You Exit-Ready

SUCCESSION PLANNING IN ACTION

Trending topics: Quick Takes on Succession

Browse our short video carousel on key succession issues—ownership, leadership, family governance, and more.

HOW READY ARE YOU FOR SUCCESSION?

Preparing for a business succession or private company exit requires clear decision-making, strong leadership planning, and clean financials. Use this checklist as a starting point to assess your succession readiness.

Learn how Richter can help?

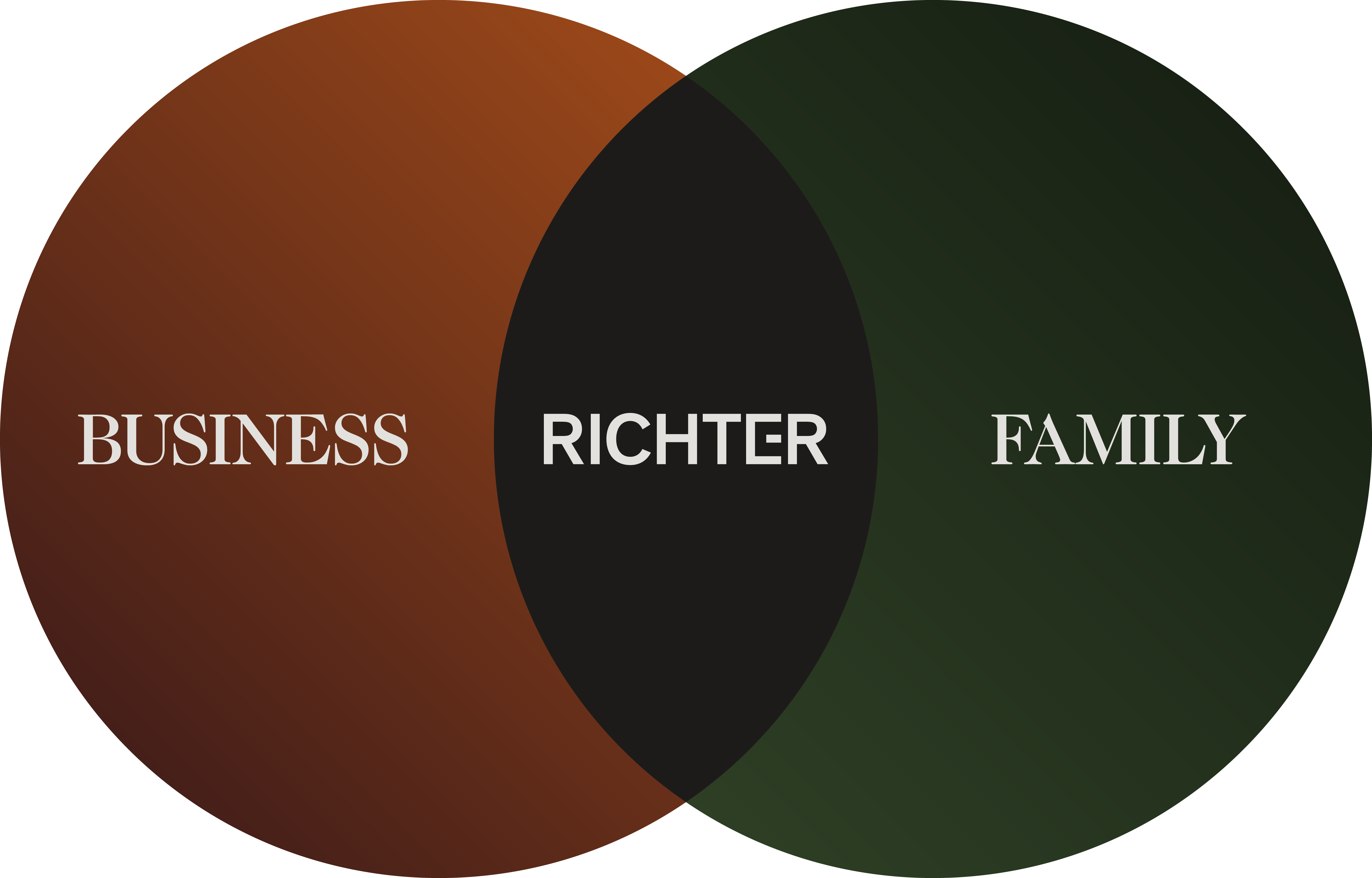

Richter blends the opportunity of business with the complexity of family

Our experience has shown us that successful companies break down silos and encourage the efficient flow of information. The best strategies are always integrated and success is based on taking in the big picture. We apply this vision to everything we do. We offer an integrated service that ensures that all energy invested in creating lasting value benefits both business and family.

Discover the Richter difference