Richterfamily office

Richter Family Office is one of the largest, fully independent, multi-family offices in Canada. We’ve been assisting some of the most successful business families for close to 100 years.

OUR MISSION

We help ensure intergenerational success and work with you and your family to build a lasting legacy. It is our mission to help you realize your aspirational goals by providing you with a bespoke suite of family office services.

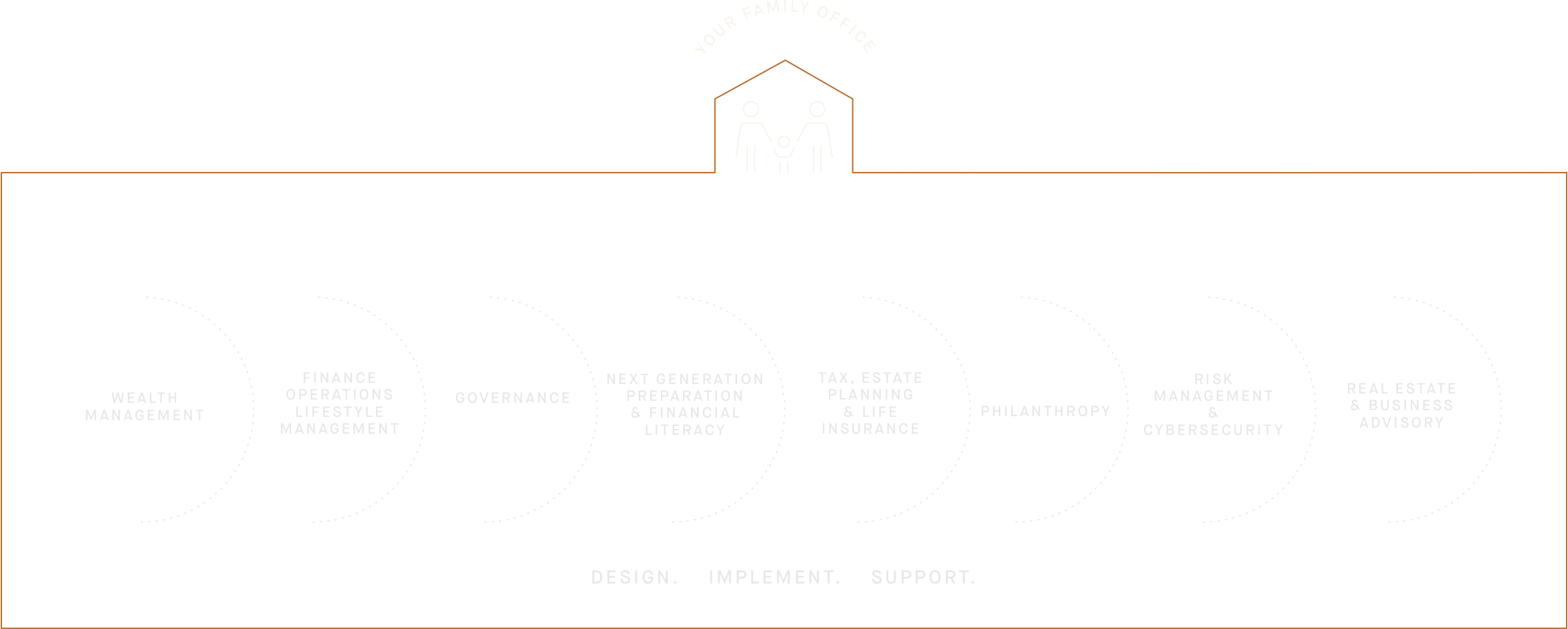

YOUR BESPOKE FAMILY OFFICE SOLUTION

We have created a full spectrum of in-house Family Office services, allowing us to provide holistic advice to wealthy individuals and their families.

You and your family are facing unique complexities: multiple types of investments, sophisticated legal structures, complicated financial and compliance requirements, as well as unique challenges relating to cash management. We act as an integrator and handle the intricacies of your financial life, designing personalized solutions based on your needs, objectives and goals.

Our approach, which always begins with an exploratory process, allows us to establish your long-term goals and objectives. This facilitates the design and creation of the Family Office solution that will best meet your specific needs. This is followed by the implementation of that solution, the success of which is ensured by our team of seasoned professionals who act as your expert C-Suite and ensure the smooth operation of your customized Family Office.

We have developed deep expertise in each of the key areas ultra-high-net-worth families need to meet their goals and objectives. This allows us to fully support your Family Office solution.

CREATING AND MANAGING YOUR WEALTH

Since inception, all of our decisions have been driven by two principles: independence and objectivity. Being fully independent through RFO Capital means that we are not beholden to one investment solution or limited by the number of investment opportunities available to us. We have access to some of the most unique opportunities from around the world and use our collective buying power as one of Canada’s largest multi-family offices to the advantage of our clients.

Running your family office

As entrepreneurs continue to create wealth through business profits or through the monetization of their value from a capital transaction, they are looking for guidance on how to design, implement and support their family office. The management and oversight of a family office requires a range of different skillsets similar to the support system of any business. At Richter, we offer a range of C-Suite level services supported by a solid infrastructure to handle operation, finance and reporting of your family office.

NAVIGATING FAMILY DYNAMICS – GOVERNANCE

With great wealth comes great responsibilities towards the community, family members and generations to follow. Developing clear governance systems ensures family harmony and, ultimately, intergenerational success. Such governance includes the establishment of a Family Charter, education, the establishment of a Family Board, a wealth transition plan and clear reporting systems.

ESTATE AND TAX PLANNING TO PROTECT YOUR LEGACY

Integrating your tax structuring is crucial for all ultra-high-net-worth families. This includes will planning, the use of trusts, estate planning, and investment structure optimization – all to maximize tax efficiencies and minimize the burden on you and your next generations. Inadequate tax planning can result in significant consequences.

KEEPING YOUR FAMILY SAFE

Preparing and protecting: life insurance can be an important investment strategy for families to provide liquidity at death or for philanthropic objectives. We can guide you through the decision as to whether life insurance can meet such objectives. Families of significant means are also increasingly the target of cyber-crime and identity theft. Richter is uniquely positioned to assess vulnerabilities and advise on best practices to help minimize security breaches and risks associated with a family’s cyber footprint.

GIVING BACK TO THE COMMUNITY – PHILANTHROPY

Charitable giving is often an expression of your core values; it represents you and your legacy to the community. It can also be a family project that brings the next generation into the fold in a meaningful way. We guide you with strategic philanthropic advice to improve charitable giving and maximize the impact on the community.

PREPARING YOUR NEXT GENERATION – FINANCIAL LITERACY PROGRAM

Richter’s Financial Literacy program is a customizable way to educate family members around key areas of family wealth and business management. Curated for participants to learn at their own pace and in their own setting, the program prepares and builds the confidence family members need to be ready to assume greater roles in the family business or wealth management endeavours.

EXPLORING REAL ESTATE OPPORTUNITIES

To optimize your portfolio and generate sustainable value for the long term, our experts support you from the initial strategy through all the transactional details of your real estate interests. We help our clients assess financial performance in combination with sector trends and geographical dynamics.

Meet our team

View all

Bill McLean

Raymond Vankrimpen

Athas Kouvaras

Greg Moore

Justine Delisle

David Leblanc

Spencer Clark

Giovanni Molinaro

Mindy Mayman

Diane Tsonos

Yuan Zhang

Eric Griffins

Karen Sankhi

Kirk Qayoom

Anastasia Lambrinos

Richard Leon

Yi Wang

Danny Ritter

Victoria Macdonald

Steffi Marcos

Alexandra Batelli

Nancy Tavoukdjian

Scott Binns

George Angelopoulos

Katherine Borsellino

Tasso Lagios

Carl Wiseman

Richterconsulting

Wealth creation comes in different forms, often from highly successful businesses.

Discover Our Business Advisory Group